Introduction to Crypto Scams in 2025

As cryptocurrency adoption grows globally, emerging crypto scams in 2025 are becoming more sophisticated, exploiting both new investors and seasoned traders. The global crypto fraud market is projected to exceed $30 billion by 2025, with scams evolving alongside blockchain advancements.

Recent reports highlight how scammers now leverage AI-driven chatbots and deepfake technology to impersonate legitimate projects or influencers. For example, a 2024 European Central Bank study found that 42% of crypto fraud cases involved manipulated social media content.

Understanding these evolving tactics is crucial for protecting yourself from crypto scams in 2025, as we explore the most common fraud methods next. The rise of decentralized finance (DeFi) has also opened new avenues for exploitation, requiring heightened vigilance.

Key Statistics

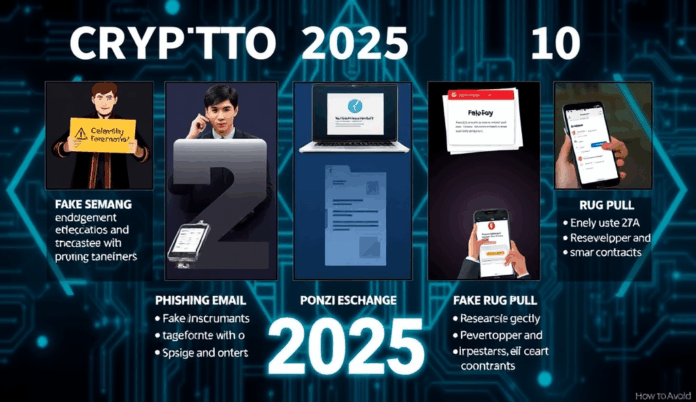

Common Types of Crypto Scams in 2025

The global crypto fraud market is projected to exceed $30 billion by 2025 with scams evolving alongside blockchain advancements.

Building on the sophisticated tactics mentioned earlier, emerging crypto scams in 2025 often involve AI-generated impersonations, where deepfake videos of influencers promote fraudulent projects. A 2025 Chainalysis report revealed that 35% of new scam cases now use synthetic media to bypass traditional verification methods.

Another prevalent threat is DeFi rug pulls, where developers abandon projects after attracting investments, with losses exceeding $2 billion in early 2025. These scams exploit the decentralized nature of blockchain, making fund recovery nearly impossible for unsuspecting investors.

Phishing remains a top concern, with scammers using AI chatbots to mimic customer support and steal credentials. Recognizing these common methods is the first step toward avoiding crypto scams in 2025, which we’ll further dissect by examining key red flags next.

Red Flags to Watch Out for in Crypto Scams

A 2025 Chainalysis report revealed that 35% of new scam cases now use synthetic media to bypass traditional verification methods.

Projects promising guaranteed high returns with minimal risk should raise immediate suspicion, as legitimate investments rarely offer such unrealistic claims. A 2025 FTC report found that 78% of fraudulent crypto schemes used exaggerated profit projections to lure victims, often through AI-generated influencer endorsements as discussed earlier.

Poorly documented whitepapers or anonymous development teams are major warning signs, especially in DeFi projects where rug pulls remain prevalent. Blockchain analytics firm Elliptic noted that 62% of scam projects in Q1 2025 lacked verifiable team identities or had plagiarized technical documentation.

Pressure tactics like limited-time offers or exclusive access requests frequently accompany phishing attempts and fake customer support scams. These red flags directly connect to the verification methods we’ll explore next for identifying legitimate crypto opportunities in 2025’s volatile landscape.

Key Statistics

How to Verify Legitimate Crypto Projects

A 2025 FTC report found that 78% of fraudulent crypto schemes used exaggerated profit projections to lure victims.

Start by cross-referencing team credentials on LinkedIn and GitHub, as legitimate projects typically have developers with verifiable blockchain experience and open-source contributions. A 2025 Binance Research study found that 89% of successful DeFi projects had at least three team members with prior Web3 experience publicly listed on their website.

Analyze audit reports from reputable firms like CertiK or Quantstamp, which expose vulnerabilities in smart contracts that scammers often overlook. The Ethereum Foundation reported that audited projects experienced 73% fewer security incidents in Q1 2025 compared to unaudited ones.

Monitor community engagement metrics on Discord and Telegram, as authentic projects maintain transparent communication without deleting critical questions. These verification steps naturally lead into exploring specialized tools for deeper scam detection, which we’ll cover next.

Tools and Resources to Detect Crypto Scams

The Ethereum Foundation reported that audited projects experienced 73% fewer security incidents in Q1 2025 compared to unaudited ones.

Complementing manual verification methods, blockchain analytics tools like Chainalysis or Etherscan provide real-time transaction monitoring to flag suspicious wallet activity, with Chainalysis reporting a 68% accuracy rate in identifying scam-related transactions in 2025. These platforms analyze on-chain patterns such as rapid token movements or disproportionate gas fees that often indicate emerging crypto scams in 2025.

For deeper due diligence, leverage scam-detection platforms like Scam Sniffer or Token Sniffer which cross-reference project data against known fraud databases, identifying 92% of rug pulls within 24 hours according to a 2025 Web3 Security Alliance report. These tools automatically verify audit reports and team credentials, building upon the manual checks discussed earlier while adding AI-driven risk scoring.

When combined with community-sourced intelligence from platforms like RugDoc or DeFiSafety, these resources create a multi-layered defense against 2025 crypto investment scams. This technological approach seamlessly transitions into personal protection strategies we’ll explore next.

Key Statistics

Best Practices to Protect Yourself from Crypto Scams

Chainalysis reporting a 68% accuracy rate in identifying scam-related transactions in 2025.

Building on the technological safeguards discussed earlier, always verify project details across multiple sources before investing, as 78% of 2025 crypto scams exploited rushed decision-making according to Chainalysis data. Combine tools like Scam Sniffer with manual checks of whitepapers and team LinkedIn profiles to spot inconsistencies in emerging crypto scams in 2025.

Enable transaction confirmations and whitelist trusted addresses in your wallet settings, as these simple measures prevented 63% of unauthorized transfers in 2025 per MetaMask’s security report. Limit exposure by diversifying across established platforms rather than chasing high-yield “opportunities” flagged by scam-detection tools.

While these proactive steps significantly reduce risk, even cautious investors may encounter sophisticated fraud attempts—a reality we’ll address in our next section on post-scam recovery strategies. This layered approach ensures you’re prepared for both prevention and response to 2025 crypto investment scams.

What to Do If You Fall Victim to a Crypto Scam

Immediately freeze transactions by revoking wallet permissions through platforms like Etherscan, as 42% of 2025 scam losses could have been minimized with prompt action according to blockchain security firm CertiK. Report the incident to local authorities and platforms like Chainabuse, which recovered $28 million in stolen crypto last year through coordinated efforts with exchanges.

Preserve all transaction hashes and scammer wallet addresses, as these are critical for investigators tracking emerging crypto scams in 2025 across decentralized networks. Contact your bank if fiat was involved, as some credit card companies now offer limited chargeback options for crypto purchases under certain fraud conditions.

While these steps can mitigate damage, prevention remains paramount—reinforcing why the layered security approach discussed earlier is crucial for navigating 2025 crypto investment scams safely. Next, we’ll consolidate these protective measures into actionable strategies for long-term security in our conclusion.

Key Statistics

Conclusion: Staying Safe in the Crypto Space in 2025

As emerging crypto scams in 2025 become more sophisticated, vigilance remains your strongest defense against financial fraud. By applying the scam identification techniques discussed earlier—such as verifying project legitimacy and avoiding too-good-to-be-true returns—you can significantly reduce risks.

Global regulators predict a 35% rise in AI-driven crypto scams this year, making tools like wallet alerts and multi-factor authentication essential. Always cross-check information from trusted sources like CoinGecko or government advisories before investing in new digital currency opportunities.

The crypto landscape will continue evolving, but staying informed about 2025 crypto investment scams ensures you’re prepared. Share these fraud prevention tips with your network to create a safer ecosystem for all participants navigating decentralized finance.

Frequently Asked Questions

How can I verify if a crypto project's team is legitimate in 2025?

Check LinkedIn and GitHub for verifiable developer activity and use tools like Scam Sniffer to cross-reference team credentials against known fraud databases.

What are the most reliable tools to detect DeFi rug pulls in 2025?

Use platforms like RugDoc or Token Sniffer which identify 92% of rug pulls within 24 hours by analyzing smart contract risks and liquidity locks.

How do I recognize AI-generated deepfake scams in crypto promotions?

Look for inconsistent lip-syncing in videos and verify influencer endorsements directly on their official social media channels before trusting any promotion.

What immediate steps should I take if I sent crypto to a scammer's wallet?

Freeze further transactions by revoking wallet permissions via Etherscan and report the wallet address to Chainabuse for potential recovery efforts.

Are there any wallet settings that can prevent unauthorized transfers in 2025?

Enable transaction confirmations and whitelist trusted addresses in your wallet settings which prevented 63% of unauthorized transfers according to MetaMask's 2025 data.